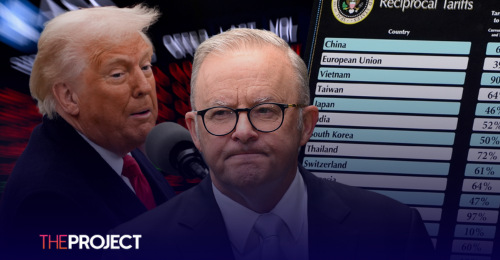

An “economic nuclear winter” – that’s the grim warning as one of the worst stock exchange bloodbaths in history continues to hit global markets. Australia is not immune, with billions of investor dollars wiped amidst fears the world is heading straight for recession.

These escalating trade tensions are casting a dark shadow over the global economy, with the superannuation accounts of Australians falling by the hour.

Within the first few minutes of trade this morning, more than $160 billion was wiped from the Aussie share market. Before regaining some ground, the ASX 200 tumbled more than 6 per cent.

Rattled investors fled in a broad and brutal market sell-off, with heavy losses in mining, banking and energy stocks.

The chaos comes in the wake of Trump’s tariff rampage.

Recession panic gripped Wall Street after China dropped its 34 per cent retaliatory tariff bombshell, triggering fears of a full-blown trade war.

Despite the tariff turmoil, the U.S. President is vowing to stick to his swing.

So, with growing fears of a recession, how will Australia navigate the global market meltdown?